Optimize Your Revenues With Professional Deal Strategies

Understanding market trends, utilizing technical analysis, and applying basic understandings are essential elements that can substantially influence trading results. What methods will verify most efficient in your trading ventures?

Comprehending Market Trends

Examining market fads is important for making informed buy and sell decisions. Understanding these fads entails identifying patterns in cost motions, volume, and market sentiment, which can give essential insights right into future price behavior. buy and sell. Investors often utilize various technical indicators, such as relocating standards and pattern lines, to recognize both bearish and bullish market problems

Market patterns can be classified into three main types: upwards, downward, and sideways. A higher fad indicates increasing costs, suggesting a positive environment for purchasing assets. On the other hand, a downward fad symbolizes decreasing prices, where selling might be extra sensible. Laterally fads display rate stagnancy, frequently requiring traders to work out caution and discover alternative approaches.

Furthermore, comprehending outside elements, such as financial indications, geopolitical occasions, and market view, can better boost one's capacity to gauge market fads properly. buy and sell. By using an organized technique to pattern evaluation, investors can place themselves advantageously in the market, enhancing their buy and offer methods.

Basic Evaluation Techniques

Key techniques consist of assessing profits records, balance sheets, and cash flow declarations. These papers reveal a company's financial health and wellness, success, and operational performance. Ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B), and Debt-to-Equity (D/E) offer relative understandings, enabling capitalists to examine whether a supply is overvalued or underestimated about its peers.

Additionally, macroeconomic aspects such as rates of interest, inflation, and GDP growth can substantially influence property worths. Recognizing these more comprehensive economic problems aids capitalists make educated choices concerning market timing and field appropriation.

View evaluation and qualitative analyses of monitoring efficiency and competitive advantages even more enhance the fundamental evaluation procedure. By integrating these methods, investors can develop a comprehensive sight of possible financial investments, eventually maximizing their profit potential while reducing danger.

Technical Analysis Tools

Technical evaluation devices give capitalists with the methods to review rate activities and market fads, enhancing the understandings got from essential analysis. These devices are crucial for traders seeking to identify entry and leave points out there.

One of one of the most extensively utilized devices is the relocating average, which ravels cost data to recognize patterns over details amount of time. Traders frequently make use of both temporary and long-lasting relocating standards to generate deal signals. In addition, the Loved One Stamina Index (RSI) is important for determining whether a security is overbought or oversold, offering understandings right into potential cost corrections.

Chart patterns, such as head and triangles or shoulders, likewise play a significant function in technological Read More Here evaluation. These formations assist investors predict future price motions based upon historical behavior. Candle holder patterns better enhance evaluation by giving visual representations of rate activity, revealing market belief.

Quantity evaluation is another vital part, showing the strength of a cost step. High quantity during an upward pattern usually confirms its credibility, while reduced quantity might recommend a lack of sentence. By utilizing these devices, investors can make informed decisions and enhance their trading techniques.

Danger Monitoring Approaches

Mitigating potential losses is a vital element of effective trading, highlighting the value of durable threat monitoring approaches. Reliable threat monitoring permits investors to secure their funding while taking full advantage of prospective returns. One essential method is to define the risk per trade, generally limiting it to a tiny portion of the complete trading funding, commonly suggested at 1-2%. This practice guarantees that no single loss significantly influences the general portfolio.

One more trick approach is the use of stop-loss orders, which automatically leave a setting once it gets to a predetermined loss level. This aids to reduce psychological decision-making and imposes technique in trading habits. In addition, diversification can minimize danger by spreading out investments throughout various properties or sectors, minimizing the impact of any type of single possession's inadequate performance.

Additionally, conducting routine analyses of market conditions and individual trading techniques can aid traders recognize potential threats and adjust their techniques accordingly. By continually applying these threat management techniques, investors can produce a more lasting trading environment, allowing them to browse market volatility with better self-confidence and eventually boost their long-term earnings.

Timing Your Professions

Effective risk administration establishes the stage for successful trading, and timing your trades plays a considerable duty in maximizing market chances. Strategic entrance and departure factors are essential for making their explanation the most of profits and reducing losses. Successful investors commonly make use of technological evaluation to recognize fads and rate patterns, permitting them to gauge the optimal moments to execute trades.

In addition, market belief and financial indications can inform timing decisions. Remaining in harmony with news events, incomes records, and financial data releases assists investors forecast potential market motions. For example, trading just before considerable news can be risky however may additionally produce significant rewards if timed properly.

Moreover, utilizing devices like stop-loss and take-profit orders can enhance your timing strategy. These mechanisms automate your departure factors, ensuring that you secure in profits or restriction losses without psychological interference.

Inevitably, timing your professions is not solely about reacting swiftly; it involves a self-displined technique to market analysis and threat monitoring. By integrating research study with tactical preparation, investors can enhance their opportunities of getting in and leaving placements at one of the most opportune moments, therefore improving their general earnings.

Final Thought

To conclude, making best use of profits in trading requires a comprehensive understanding of market dynamics via both essential and technological analysis. Utilizing devices such as moving averages and the Family member Toughness Index click to read more boosts the capacity to identify ideal trading possibilities. Furthermore, efficient danger monitoring approaches are vital to alleviate prospective losses. Eventually, a regimented method to timing trades can substantially boost total trading efficiency and productivity in the ever-evolving economic markets.

Understanding market patterns, using technological evaluation, and using fundamental understandings are crucial parts that can substantially influence trading results. Recognizing these fads involves recognizing patterns in cost movements, quantity, and market sentiment, which can provide essential understandings into future price behavior. Traders often utilize numerous technological signs, such as moving standards and trend lines, to recognize both bearish and favorable market problems.

Additionally, recognizing exterior aspects, such as economic indications, geopolitical events, and market belief, can even more boost one's capability to evaluate market fads efficiently.In verdict, making the most of earnings in trading requires a comprehensive understanding of market dynamics via both fundamental and technological analysis.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Suri Cruise Then & Now!

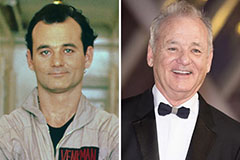

Suri Cruise Then & Now! Bill Murray Then & Now!

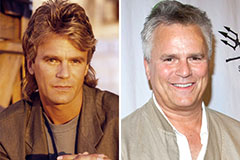

Bill Murray Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!